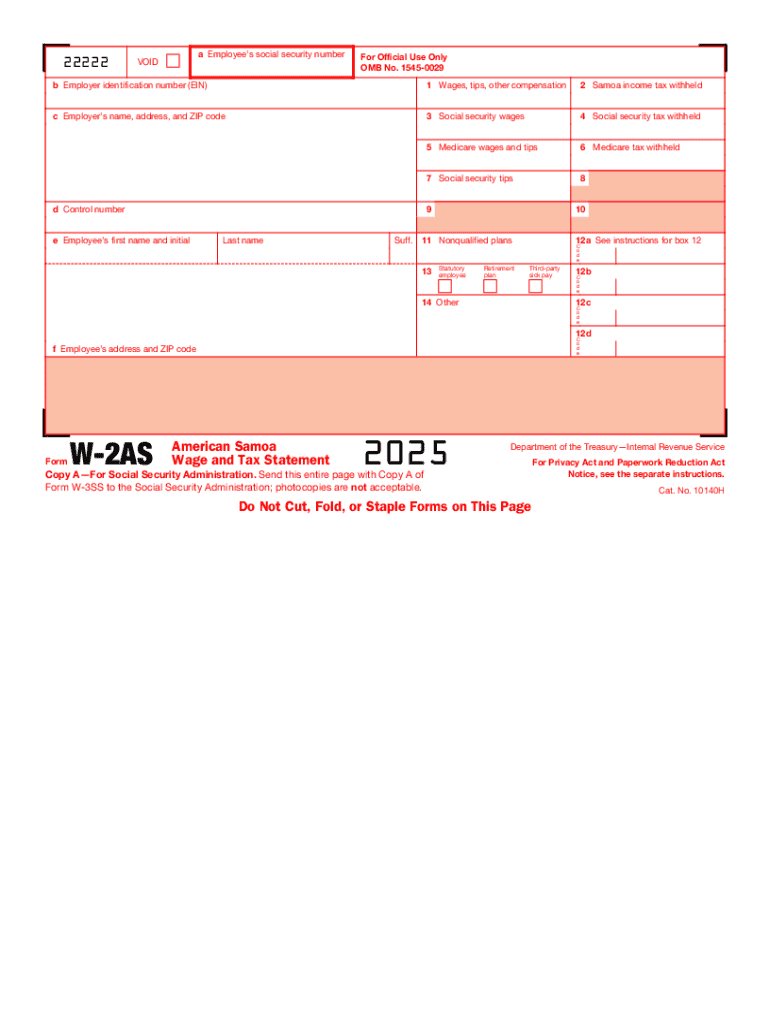

IRS W-2AS 2025-2026 free printable template

Instructions and Help about IRS W-2AS

How to edit IRS W-2AS

How to fill out IRS W-2AS

Latest updates to IRS W-2AS

All You Need to Know About IRS W-2AS

What is IRS W-2AS?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS W-2AS

What should I do if I discover an error after submitting my IRS W-2AS?

If you find a mistake on your IRS W-2AS after submission, you need to file a corrected version promptly. This process involves completing Form W-2c, which is specifically designed to correct errors reported on W-2 forms, including the IRS W-2AS. Ensure that you indicate the corrected entries clearly to avoid any confusion during the IRS review process.

How can I verify if my IRS W-2AS has been processed by the IRS?

To verify the processing status of your IRS W-2AS, you can utilize the IRS e-file tools available online. If you filed electronically, confirm the submission receipt via your e-filing software. It’s essential to keep track of any confirmation numbers or emails until your status is fully confirmed to guard against potential filing issues.

Are e-signatures acceptable for submitting the IRS W-2AS?

Yes, e-signatures are generally acceptable when filing the IRS W-2AS electronically. However, ensure that your signature complies with IRS requirements regarding authenticity and integrity. It’s vital to keep records that demonstrate the consent of the signatory to maintain compliance with data security guidelines.

What common errors should I be cautious about when filing the IRS W-2AS?

Common errors when filing the IRS W-2AS include incorrect taxpayer identification numbers and mismatched names. Double-check all entries and ensure that they match the records of the IRS to avoid rejection. Additionally, missed fields or providing incomplete information can lead to processing delays.

What should I do if I receive an IRS notice regarding my IRS W-2AS?

If you receive a notice from the IRS about your IRS W-2AS, read it carefully to understand the issue raised. Respond promptly, providing any requested information or corrections. Gather documentation related to the original submission and any amendments made to prepare a thorough response, ensuring that you address all points raised to prevent further complications.

See what our users say